# Guide: Exiting early as a Large LP

We recommend large LPs to keep YTs when providing liquidity. This has two purposes:

- To sell YTs in batches once liquidity improves, thereby limiting their exposure to slippage.

- To fully exit an LP position before maturity by early redeeming PTs with minimal slippage

This guide describes the steps to utilize #2.

# Introduction

When Space LP wants to exit before maturity, they typically remove liquidity from the Space AMM and sell their PT side back into the pool.

For small LPs, there’s enough liquidity to sell their PTs. For large LPs, however, their liquidity makes up a large portion of the pool’s assets, and therefore they’d be exposed to dramatic slippage when attempting to sell their PTs.

# Guide

To help large LPs exit their position, we’ve added a couple of portal features that allow LPs to exit before maturity with minimal slippage.

The only requirement is that they hold YTs of the same size and series as their PTs (in their LP position).

Here’re some basic instructions (using goerli for the demo):

- You have some amount of LP tokens and YTs, and you want to convert them all into Target (aka, the yield-bearing asset)

- Head to

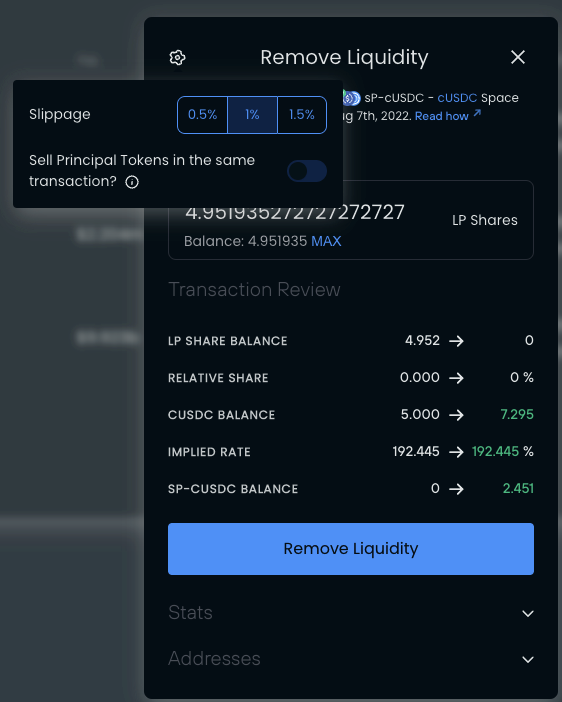

Portfolio page / Your Positions / LP shares→Manage→Remove liquidity - [Remove PTs & Target from LP position]. Make sure the toggle is disabled. You’ll receive the Target & PTs.

- You now have Target & PTs. Let’s exit your PT position.

- Head to

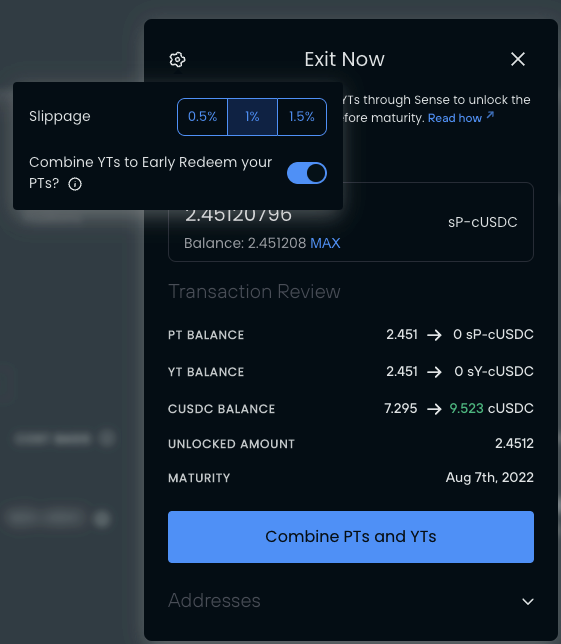

Portfolio page / Your Positions / Principal Tokens→Manage→Exit Now - [Combine PTs & YTs] Make sure the toggle is enabled. You’re combining PTs and YTs to unlock the principal before maturity.

- If you were a very large LP, you might not be able to exit your entire PTs or YTs position remaining after combining. In this case, you might sell off a smaller piece of your position or hold the asset until maturity. Otherwise, you now have Target (aka, the yield-bearing asset, like wstETH).