# Guide: Block Trading on Sense

This guide describes a process for self-organizing interest rate block trading (opens new window) on Sense Protocol. With it, large market participants can self-match P2P to circumvent Space AMM liquidity constraints.

# Introduction

The Sense Protocol creates a two-sided marketplace, comprised of PT buyers fixed rate lenders and YT buyers future yield traders.

PT buyers are buying interest rate protection and selling variable rate volatility, and YT buyers are doing the opposite — selling a fixed rate and buying variable rate upside. For more information, please visit the use case documentation (opens new window).

Users buy PTs and YTs from LPs on the Space AMM.

Large market participants who want to minimize their slippage costs, or purchase amounts larger than the outstanding liquidity, can self-match P2P with the opposite side of the market (PT or YT buyers).

In other words, users can trade P2P without being subject to LP liquidity in Sense Space.

This guide describes the following P2P lifecycle for User A (PT buyer) & User B (YT buyer):

- Mint - User A mints PTs & YTs

- Trade P2P - User A sells YTs to User B (to lock in an effective fixed rate)

- Sell early (optional) - PT & YT holder can sell back into the Space AMM, but this is subject to Space liquidity

- Redeem - PT & YT holders close out their positions at or after maturity

# Guide

We assume the reader is a PT buyer (fixed rate lender). We'll cover an example of selling future yield of wstETH to lock in a fixed APY in stETH, a liquid staking derivative that's usually pegged to ETH.

# Mint

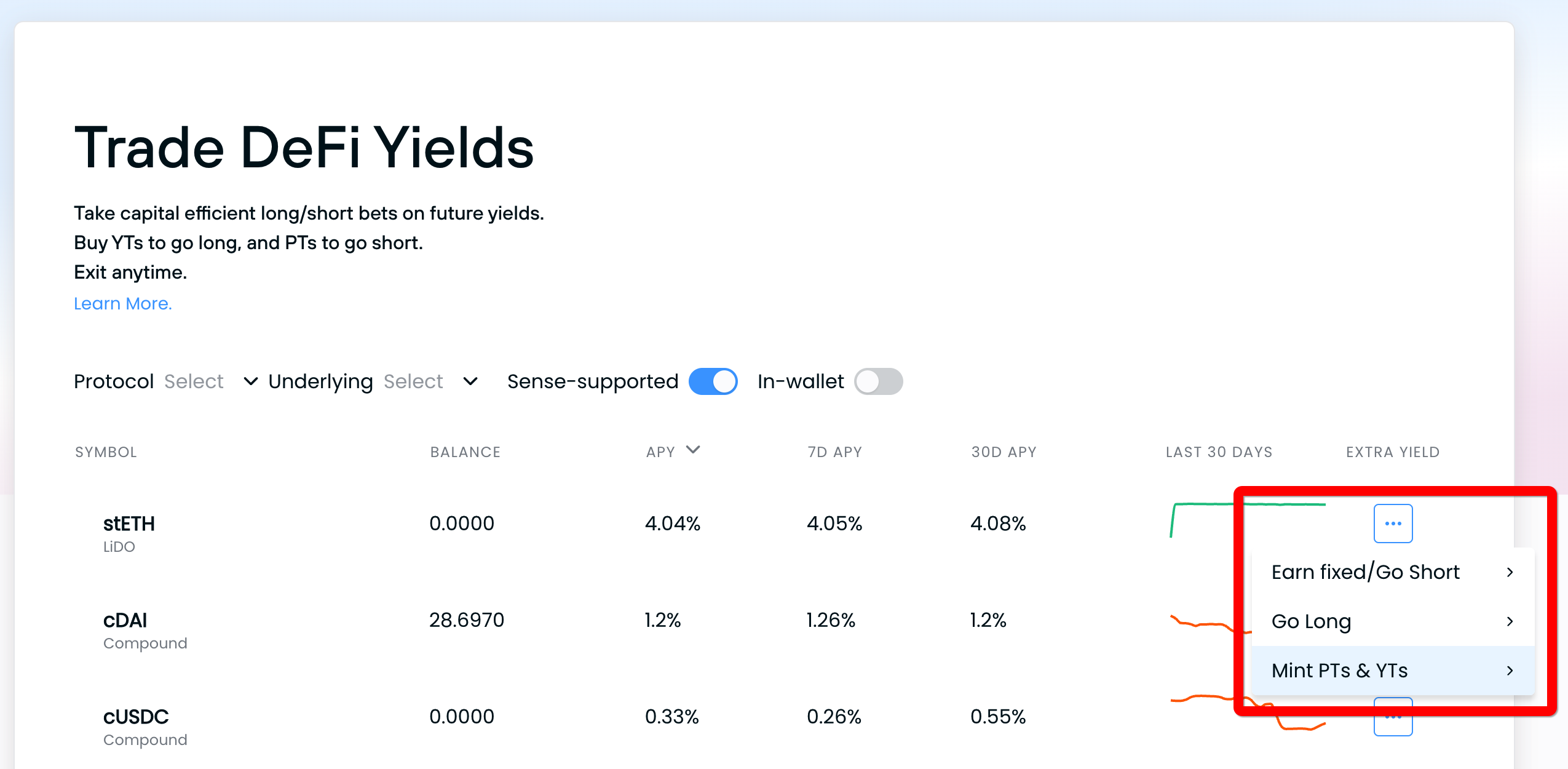

You, the PT buyer, are essentially lending your stETH to YT buyers for a fixed term, meaning that you're bringing the majority of the capital. Therefore, you mint wstETH PTs & YTs. To do so, visit the Trade page (opens new window), click the ... button in the "Extra Yield" column on the row of your desired yield-bearing asset, and select Mint PTs & YTs.

Select the series you wish to earn a fixed rate from, the desired amount of wstETH or stETH, and click Mint. Under the hood, you’re giving your assets to the Sense Protocol, and the protocol is minting PTs & YTs for you. If you made a mistake, you can combine PTs & YTs at any time, one-to-one, to redeem an equivalent amount of underlying in target terms (i.e. one-to-one of stETH worth of wstETH), as described in Step #5 of this other guide (opens new window). Note that every mint is subject to an issuance fee (typically 0.10% of underlying, e.g. stETH).

# Trade P2P

Now that you have PTs & YTs, it’s time to sell your YTs for its underlying (i.e. selling wstETH YTs for stETH).

Find someone that wants to buy YTs, and sell it to them via 1inch P2P Limit Orders (opens new window), Matcha Limit Orders (opens new window), Airswap (opens new window), Sudoswap(legacy) (opens new window), or another OTC settlement mechanism.

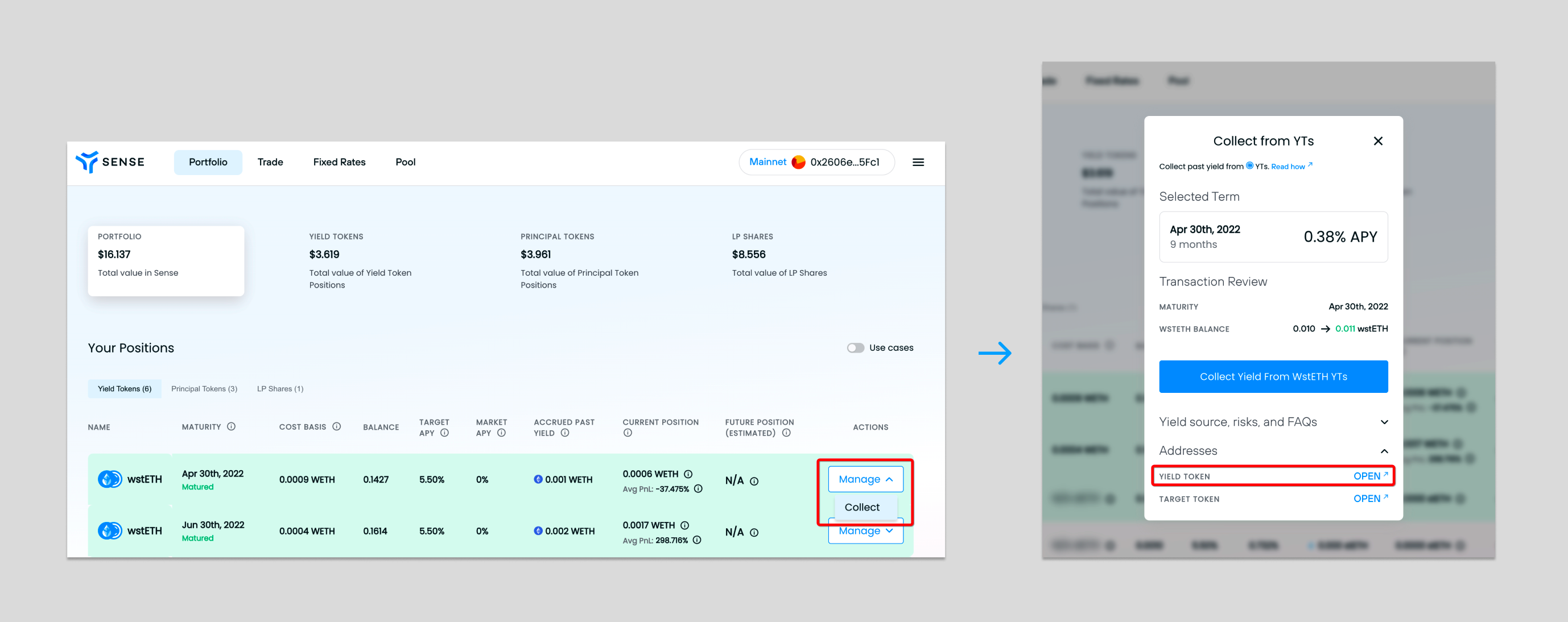

Most limit order dapps, like 1inch & Matcha, require you to import the YT address when preparing the offer. To locate the address of your YTs, head on over to your Sense Portfolio page on app.sense.finance to see your YT position, click Manage, then Collect, and finally the Address drop-down to find the YT address. From etherscan, copy and paste this address into the limit order UI.

Once you've inserted your YT address, you'll want to select its Underlying (in your Portfolio, the underlying is visible under the Accrued Past Yield column) as the receipt token.

Next, use this calculator to determine what price to sell the YTs for (opens new window), insert the amount of Underlying you wish to purchase, and submit the offer. Finally, grab a hyperlink link to the offer after submission, and share it with the other party (the one buying the YTs).

Once your order to sell YTs is filled, you’re left with wstETH PTs & some of your original asset (stETH). By selling YTs, you're "pulling forward" your future yield to lock in a fixed rate. Congrats!

Next, you'll hold your PTs and use them to redeem/unlock your principal at maturity.

# Sell early (optional)

As a PT/YT holder, you’re welcome to sell into the Space AMM if you need liquidity before maturity. To do that, head over to the Sense Portal (opens new window).

Note that the price & slippage costs are subject to Space AMM liquidity.

# Redeem

At maturity, PT and YT holders can close out their trades through the Sense Portal by heading to the Sense Portal (opens new window) and:

- redeeming PTs for the underlying asset

- collecting yield from YTs

# Disclaimer

Disclaimer: This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Sense Finance or its affiliates and does not necessarily reflect the opinions of Sense Finance, its affiliates or individuals associated with Sense Finance. The opinions reflected herein are subject to change without being updated.