# Sense Protocol Litepaper (Outdated)

# Abstract

In this litepaper, we introduce a decentralized protocol that enables fixed rates and future yield trading on existing yield-bearing assets. We describe a practical design pattern that escrows tokens ("Target") and issues an arbitrary number of tokens that hold a claim on the Target in the future. Each token type will have their own delivery schedule and are valued by market participants based on their Target cash flows. The Sense Protocol applies this design pattern to yield-bearing assets by allowing users to decompose the principal and yield components and package them behind two maturing assets, a Principal Token and a Yield Token. Principal Tokens (PTs) redeem 1-for-1 for the Target's underlying at maturity, whereas Yield Tokens (YTs) deliver yield accrued on the underlying until maturity. Because the protocol is not issuing debt, the protocol is able to take a permissive approach, allowing its users to add a yield curve to any yield-bearing asset.

# Introduction

DeFi Lending Protocols offer open-term crypto-collateralized borrowing and lending. To offer continuous positions, these protocols – such as Compound and Aave – respond to changes in market forces by adjusting interest rates. These floating interest rates are essential for the health of these lending protocols, as they ensure enough liquidity exists for borrowers and lenders to adjust their positions. However, it leaves out a large segment of potential users that fear interest rate volatility. Therefore, to expand the value proposition of DeFi and serve mainstream users, our industry requires the ability to hedge against interest rate volatility.

Multiple projects are tackling this problem. Zero Coupon Loan Facilities, such as Yield (opens new window), Notional (opens new window), and HiFi (opens new window), accept collateral assets, e.g. ETH, and mint their own zero-coupon tokens, redeemable 1-to-1 at a future date for a target asset, such as DAI, which is either sourced from physical or synthetic settlement, depending on the protocol. Others pursuing a similar design, such as UMA, rely on a cash settlement mechanism, which delivers an amount of collateral proportional to the target asset delivered at maturity. Since ZCLs mint a synthetic asset (its zero-coupon token), backed by some volatile collateral, there is a possibility that their liquidation systems cannot discharge collateral fast enough in a bear market, leading to underwater debt positions. Underwater debt positions can cause a whole host of problems, ranging from a malfunctioning settlement mechanism to the infamous insolvent protocol state, where its total liabilities (zero-coupon tokens) exceed its total assets (collateral).

88mph offers a compelling alternative. Instead of following the ZCL model, it focuses on yield generation systems, such as Compound, Aave, and Harvest, and extends Fixed-Interest Rate Bonds (FIRBs) on fixed-term deposits. The fixed rates are determined by governance-authorized interest rate models. Currently, its only authorized model offers a fixed APY equivalent to 75% of the monthly exponential moving average of the chosen yield-bearing asset. However, if the underlying APY drops after a deposit, 88mph may fail to guarantee its fixed rate. To mitigate this risk, the protocol pools deposits together and enables floating-rate bonds (FRBs), allowing other users to act as fixed-rate guarantors in exchange for excess yield-generated proceeds [ref (opens new window)]. This model has two drawbacks. First, the interest rate models are rudimentary and require governance approval. This leads to suboptimal rates for fixed-rate lenders and slow expansion to more sophisticated models. Second, the design restricts FIRB/FRB holders from exiting prematurely. Because FIRB positions are tokenized as NFTs, they lack liquid markets. Furthermore, FRB holders are second-class citizens and have "temporary or permanent default risk if the FIRB's holder doesn't withdraw the full face value of the FIRB at maturity" [ref (opens new window)]. Although 88mph is working on other mitigation methods, such as a Zero Coupon Bond wrapper for FIRBs, the improvements are still in early stages and yet to be proven at scale

The Sense Protocol introduces a practical design that allows users to decompose a yield-bearing asset into its principal and yield components and package them behind two maturing assets, a Principal Token (PT) and a Yield Token (YT). With PTs and YTs, users can safely earn/borrow at a fixed rate and trade against future yields without the risk of liquidation and capital lock-ups. Sense does not issue debt and does not carry a risk of insolvency. Governance has been minimized and the protocol relies on market participants to value its assets. Therefore, the protocol can safely expand into a variety of yield-bearing assets and scale without limits.

To place YTs among the yield token instruments from other stripping protocols, Sense utilizes the Collect Yield Token (YT) design (opens new window).

# Divider

Fundamentally, Sense is designed to receive and escrow ERC20 tokens (“Target”) and issue an arbitrary number of tokens that hold a future claim to a portion of the Target.

The Divider segments and delivers portions of Target to a set of tokens as a function of some predefined condition. Each token type can have its own delivery schedule. Some tokens could receive a fixed value of Target, acting like vanilla zero-coupon bonds, whereas other tokens could receive a floating value of Target, acting like floating zero-coupon bonds and trading at a discount (opens new window) to their expected redemption value. More exotic token types could receive Target continuously up to a future date instead of in a single future cash flow.

For every Divider application, the separation logic is arbitrary, unique to each Target, and can include multiple types of tokens.

The Divider offers powerful scaffolding for custom logic and case-specific conditions, ranging from historical interest rates to AMM pool fees.

The Sense lifecycle is simple and split into three stages.

Issuance

Issuance begins with a user specifying a maturity date and depositing the Target into Sense. In the same call, the Sense mints various tokens, per the Divider, and transfers them to the message sender.

Escrow until maturity

Depending on their use case, the user can either hold their tokens until maturity or sell them after issuance. If the user holds all tokens until maturity, they are effectively holding the Target. At any point, a user can combine and burn all tokens and withdraw some Target before maturity — this is called Early Redemption.

As mentioned above, some token types could deliver Target before maturity, but other types will wait until maturity before making Target redeemable to its holders.

Redemption

On or after the maturity date, some token types may be burned to redeem a proportional amount of the Target.

# Application: Yield Bearing Assets

In this litepaper and first releases of the Sense Protocol, we demonstrate an application of the Divider with Ethereum-based yield-bearing assets. A yield-bearing asset is defined as any token that is inherently accruing yield on some underlying asset at some interest rate. In DeFi, Yield is generated from lending, exchange, protocol dividends, staking and arbitrage. Examples of yield-bearing assets include cTokens, aTokens, Yearn Vaults/iEarn tokens, Dai in the DSR (CHAI), wstETH, and AMM LP tokens.

# Rate Accumulator

The assets mentioned above all utilize a Rate Accumulator Design Pattern to apply an interest rate to an on-chain balance efficiently. Whether the goal is to distribute yield to all USDC Yearn Vault owners or apply stability fees (opens new window) on all ETH-A Maker Vaults, the fundamental operation distributes assets or liabilities across an arbitrary number of owners with the update of a single global variable.

The design pattern can be generally defined as:

where,

Here are several examples:

In Maker, Vault owners hold a normalized balanced, called art, rather than their DAI debt since their debt continuously accumulates at some stability fee rate. To determine the amount of debt they owe at any given time, Vault owners multiply their art balance by the collateral type's current scaling factor, called rate.

In Compound, cTokens' ERC20 token balance represents the normalized balance, rather than the total value of their lending position, since their balance is always accumulating at the floating cToken supply interest rate. The scaling factor, in this case, is the cToken's exchangeRate between the cToken and the underlying token.

Similarly, the norm is the ERC20 token balance, and the scale is pricePerShare in Yearn Vaults.

# Principal Tokens and Yield Tokens

For this application, we present a Divider design that escrows yield-bearing assets (Targets) until some maturity and creates two tokens: a Principal Token and Yield Token. A Target is a yield token that accrues interest on some Underlying asset. Principal Tokens are like vanilla zero-coupon bonds, redeeming 1-for-1 for the Target's underlying at maturity, whereas Yield Tokens are a new type of yield-only instrument, continuously delivering yield accrued on the underlying until maturity. Delivery occurs at the time of transfer or redemption, where the former YT holder is sent some Target before losing custody. Therefore, it adopts the Collect YT design, as described in Designing Yield Tokens (opens new window). With PTs and YTs, the following user stories emerge:

# User Types

# Yield Traders

Yield Traders predict a rise or fall in the expected Target Interest Rate. They purchase YTs to go long or purchase PTs to go short.

# Liquidity Providers

Liquidity Providers are already holding the Target and would like to earn trading fees, so they issue new PTs & YTs, add liquidity to the respective markets, and redeem PTs & YTs for the Target or roll over to the next maturity.

# Fixed Rate Lender

Fixed Rate Lenders are looking for a fixed yield over a fixed term, so they buy PTs and hold until maturity to lock in a fixed interest rate in underlying terms.

# Fixed Rate Borrower

Fixed Rate Borrowers have an existing on-chain loan on Maker, Compound, Aave, etc, and would like to fix part of their loan's interest rate, so they buy and hold YTs to hedge their borrowing rate volatility for a fixed term.

# Arbitrageurs

Arbitrageurs mint, burn, and trade PTs & YTs when their aggregate value drifts from one unit of their underlying asset. For more information, visit the PT/YT Arbitrage section below.

# Series Actors

Discussed further in the next section, Series Actors are incentivized to maintain the Target's term structure within Sense. They include Series Sponsors, Series Settlers, and Series Rollers.

# Series & Settlement

A Series defines a type of PT & YT with a unique maturity. Both PTs and YTs are fungible with other PTs and YTs of the same Target and Series.

YTs are streaming Target to their holders before maturity, whereas PTs redeem for Target after maturity. To determine how much Target to distribute to PT & YT holders, Sense needs only the Target's scale value at issuance and maturity, which is captured when the Series is initialized and settled, respectively. To initialize a Series, one sets a new maturity date and deploys token contracts for PTs and YTs. On the other hand, to settle a Series, one passes in the Target's scale value into Sense at or around maturity.

Series Sponsors are actors who initialize new Series. They put up a stablecoin stake that becomes part of the Settlement Reward and are given exclusive access to settle their series for a short grace period before Sense opens the privilege up to the public, where it becomes MEV.

If a series is not settled within the grace period, Series Settlers are actors who settle the Series and harvest the reward. They are incentivized by the Settlement Reward which is composed of the sponsor's stablecoin stake and the accumulated issuance fee of the Series.

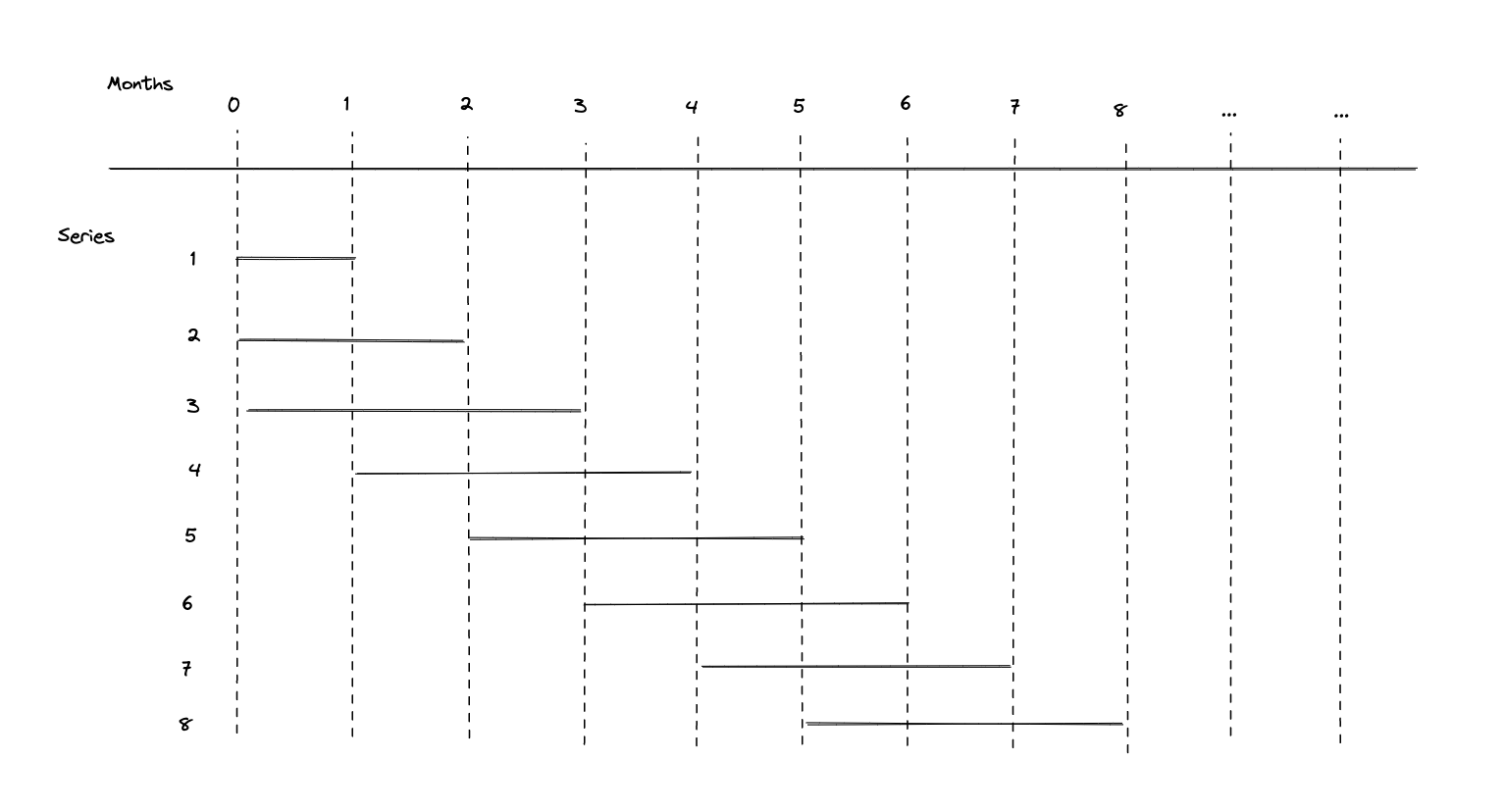

A Target's term structure (opens new window) within Sense is composed of all active series for a given Target, and its form is defined by parameters configurable by Sense Governance. In an ideal world where infinite liquidity exists, a term structure need not be constrained, and users will have the liberty to interact with any market along the yield curve. However, we don't have the luxury of ideal liquidity conditions, so to mitigate liquidity segmentation in the absence of that luxury, Sense V1 will be launched with the following constraints:

- Three (3) active Series per Target

- Maturity dates must land on top of the month, 00:00 UTC

The following diagram shows the evolution of the Target's term structure. Excluding the tops of months, where Series mature and initialize, there should be three active Series at any point in time.

# Valuation Framework

Valuation models help to price assets. Below are simple, educational models for PTs & YTs that market participants can modify. Both models rely on the law of one number [ref], or a method for finding the Present Value (PV) of future cash flows. Because of the time value of money, future cash flows are worth less in today's terms, so they need to be discounted back to the present day.

Assuming the buyers hold these assets until maturity, the following valuation models assist with pricing the initial sale, and subsequent trades of PTs & YTs anytime before maturity. Note that these models are considered rudimentary and should not be relied on for investment decisions.

# Principal Token Valuation

Principal Tokens redeem 1-for 1 for the Target's underlying on or after its maturity. As discussed in the Architecture section, PTs that are not redeemed at maturity will automatically accrue yield at the Target's interest rate thereafter, but the following valuation will assume redemption occurs at maturity. As a result, a PT will trade at a discount to its redemption value. It’s similar to a zero-coupon bond, where there are zero coupon payments made before maturity, and the discount implies the yield. Thus, it is appropriate to adopt the valuation model used to value a single future cash flow. For this, we use the following equation to determine the present value of PTs before maturity [ref]:

We perform algebraic manipulation to solve for :

where:

= Present value = market price of Principal Token [Underlying]

= Future value = redemption value of on Principal Token [Underlying]

= annual discount rate

= number of years until maturity (can be fractional)

The discount rate is in an annualized form and is driven by the market. Price equilibrium is bound to surface as Fixed-Rate Lenders, Liquidity Providers, and Arbitrageurs participate in interest rate discovery. The current Target interest rate will ostensibly be used as a reference, but signals from the markets and Target ecosystem will likely influence the market price; for example, if Compound Governance is expected to increase the COMP rewards on cDAI, the open market will likely expect supply rates to increase as the cDAI market utilization increases and price the Principal Tokens accordingly.

For example, if a series of cDAI Principal Tokens matures in three months and has a price of 0.972 DAI, the implied yield to maturity is 12.03%.

# Yield Token Valuation

YTs follow the Collect Yield Token (YT) design. YTs will price as the discounted expected future yield. A rudimentary pricing model can be found here (opens new window).

# PT/YT Arbitrage

Without limits, a user can issue and burn Principal Tokens & Yield Tokens to either increase or decrease the token supplies before their maturity. Issuance and burning begins and ends with the Target, respectively, and is typically performed by arbitrageurs. The following operation is called PT/YT Arbitrage and can be used to earn risk-free profit in Target terms.

Whenever there's a premium on PTs & YTs such that their aggregate value is greater than a unit of Underlying required for issuance, arbitrageurs will perform delta neutral arbitrage, earning a profit in Target by issuing new PTs & YTs to sell on the market premiums. The same incentive occurs in market discounts. Arbitrageurs will purchase discounted PTs & YTs and combine them to early redeem some Underlying worth of Target before maturity. Moreover, only the aggregate value of the PTs and YTs are assessed, so there need not be a premium/discount in both markets - in other words, a comparable market condition is one where PTs are trading at a steep discount and YTs are well behaved.

The existence and size of the arbitrage profit is a function of many factors, including:

- PT & YT price

- Exchange slippage

- Gas costs with issuance/early redemption & exchange swaps

- Exchange trading fees

Arbitrageurs will continue to trade with mis-priced markets until the aggregate value of PTs and YTs are within proximity to their Underlying value. The profit threshold creates a spread around the Underlying value where the combined value of PTs and YTs are free to float within, similar to DAI's soft peg to USD. Assuming efficient markets, zero exchange fees, and perfect arbitrage, the following relationship holds in a common denomination:

# Liquidity

Liquidity is one of the most important measures of any capital market. In the Sense ecosystem, more liquidity benefits both buyers & sellers of PTs & YTs, as it reduces the slippage when entering/exiting a position, and enables larger position sizes, more volume, and greater fees [ref (opens new window)]. Therefore, Liquidity Providers play a crucial role in Sense’s usability, so ensuring a smooth user experience for providing liquidity is of utmost concern in the protocol's design.

Liquidity Providers are free to market their freshly issued PTs & YTs on the trading venue of their choosing, but we recommend utilizing Sense Space.

Sense Space is a PT/Target AMM Pool built on Balancer V2. Each series has a unique Space, and all PT & YT trading go through its liquidity. It implements the yieldspace invariant (opens new window), and it offers a host of benefits:

- LPs - More yield from greater capital efficiency

- LPs - Principal protection in underlying terms if held until maturity

- LPs - no time-dependent IL

- Traders - Less slippage & price impact

Sense Space is a recent addition to the Sense Protocol and is described in our introduction post (opens new window).

# Governance

Later versions of the Sense Protocol will be governed by the SenseDAO which consists of Sense token holders and on/off chain governance structures. Although the Sense Protocol is designed to be minimally intrusive and simple in construction, there will be system parameters and future development that need adjustment and direction, respectively. Including all types of users and reaching stakeholder alignment is a critical part in ensuring the long-term sustainability of the SenseDAO and surrounding ecosystem.

We believe the most impactful organizations are those that have a diverse array of stakeholders as well as an organizational resilience to paradigm shifts in technology and finance. Building this resilience embraces the DAO structure and its advantages in scalability and stakeholder reach. Our goal is to create an unstoppable DAO which accelerates the world's transition to open finance through efficient, equitable fixed-term products.

The Sense founding team will bootstrap the initial release of the Sense Protocol. Using the Progressive Decentralization playbook, we will take an incremental approach to introducing Sense Governance and will hand-off control over time as product-market fit forms and when the team can sufficiently decentralize operations, eliminating dependency and information asymmetry [ref (opens new window)].

Once the project has been decentralized, the SenseDAO will have the tools needed to continue operations and future development through the following protocol fees:

- Issuance Fee - variable fee charged at the time of issuance

- Yield Fee - variable fee charged on yield distribution of YTs

- Flash Fee - variable fee charged during Sense provisioned flash loans

Although the implementation will be present, Sense will be launched with zero fees going to the protocol. Only the SenseDAO has the privilege to enable protocol fees.

Note that there is a separate issuance fee that's apart of the Series Settlement Reward, used to compensate Series Actors for managing Sense's term structures. This will exist at the time of launch and is claimable by Series Sponsors/Settlers. More information can be found in the Series & Settlement section.

# FAQ

# What are Keepers?

A Keeper is an independent actor that is incentivized by profit opportunities to interact with DeFi applications in various capacities [ref (opens new window)]. Ranging from maintenance duties to arbitrage performances, the role of a keeper is multifaceted and is leveraged by decentralized protocols to the betterment of the application's operation, which include but are not limited to important system adjustments and market cohesion. For example, keepers help both the Maker Protocol remain solvent by kicking off Vault liquidations [ref (opens new window)] as well as the Fei Protocol in reweighing the FEI-USD peg [ref (opens new window)]. In both cases, there are on-chain incentives that are simultaneously distributed to the keepers for their service.

# Disclaimer

This paper is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. This post reflects the current opinions of the authors and is not made on behalf of Sense Finance or its affiliates and does not necessarily reflect the opinions of Sense Finance, its affiliates or individuals associated with Sense Finance. The opinions reflected herein are subject to change without being updated.