# Tutorials

# How to Get A Fixed Rate

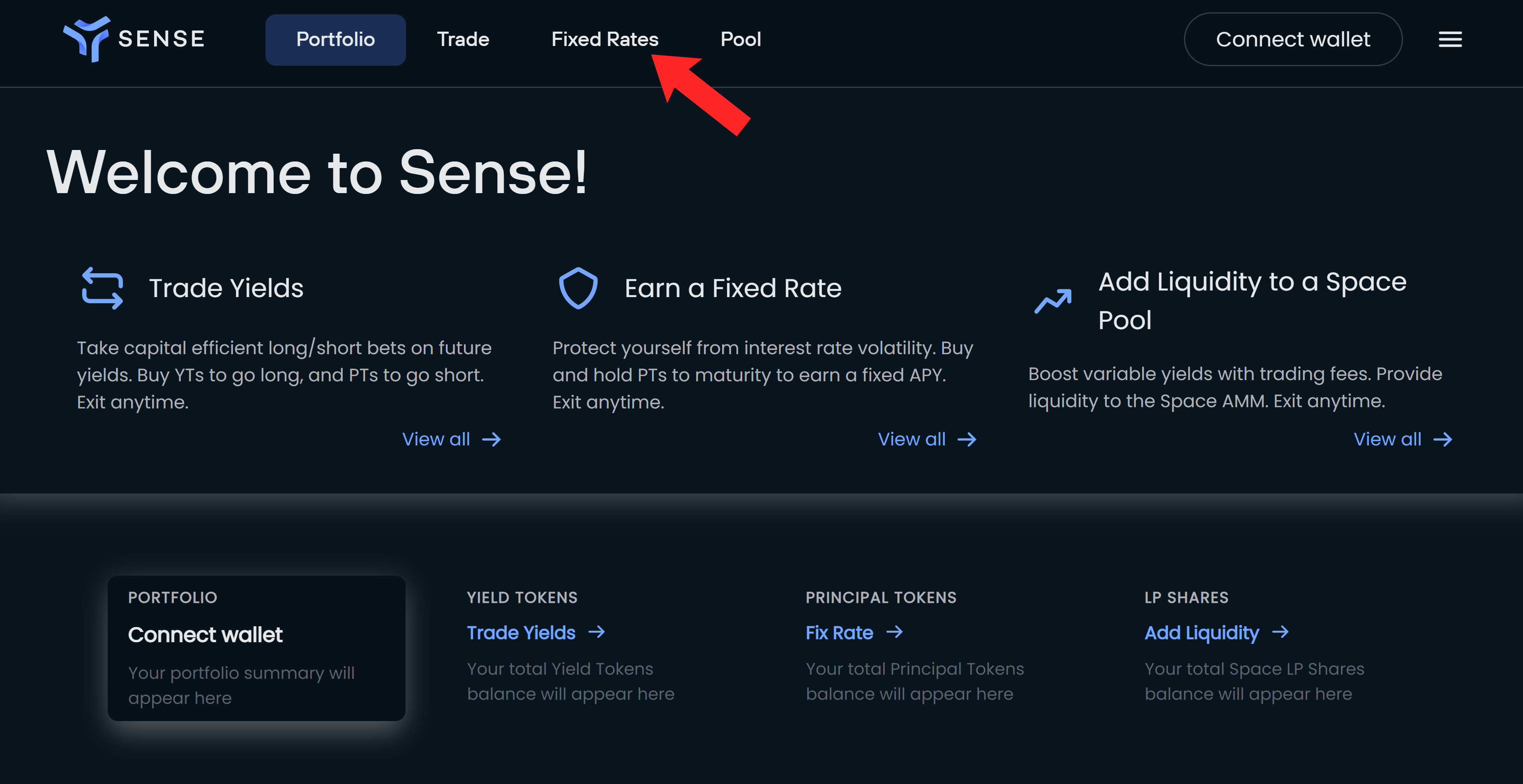

First, from wherever you are in the Portal, switch to the “Fixed Rates” tab.

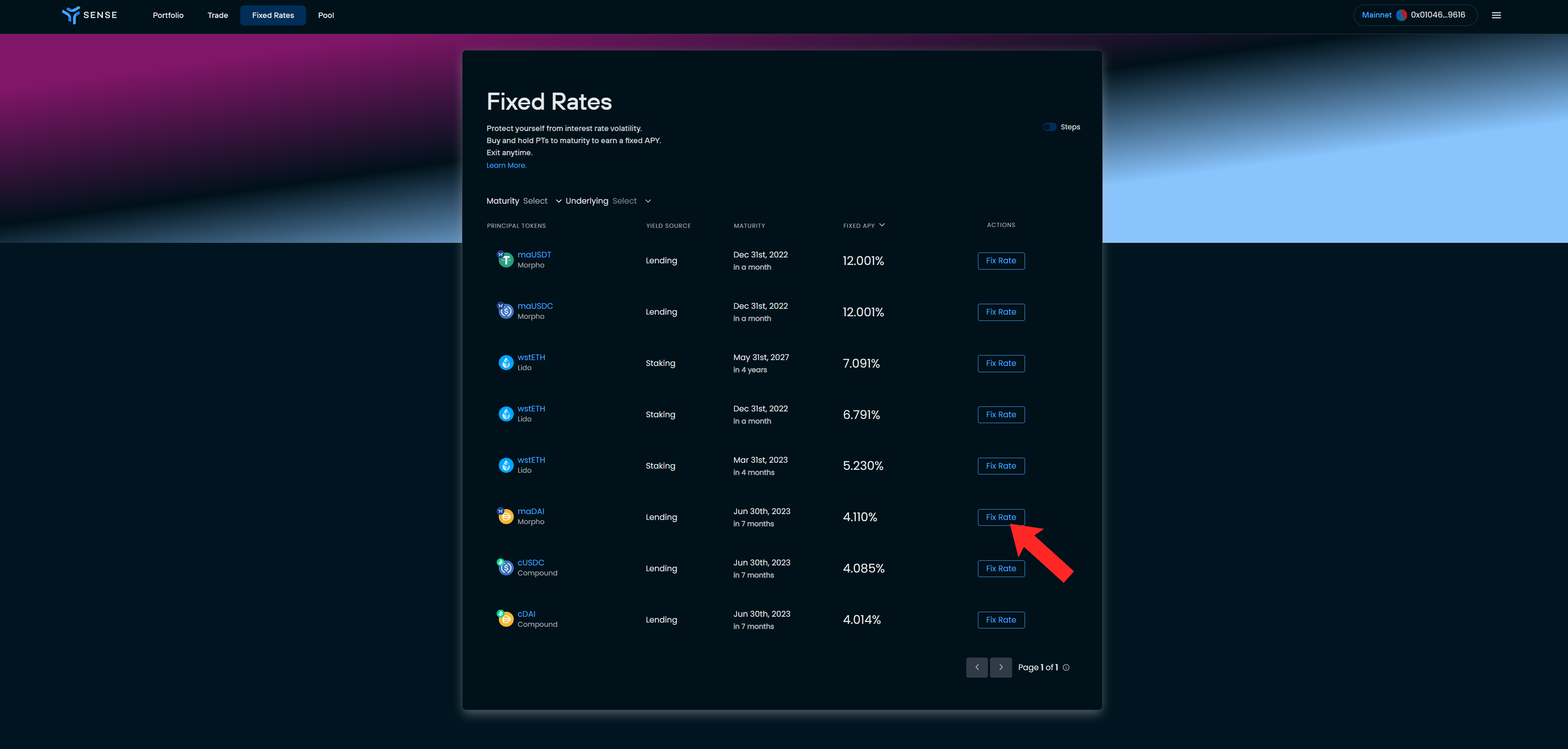

From the “Fixed Rates” tab, you can select the fixed rate you would like by clicking “Fix Rate” beside that series. Different series are based on different assets, and have different maturities and different available rates. Here we’ve selected a June 30th 2023 maDAI series with a 4.110% rate.

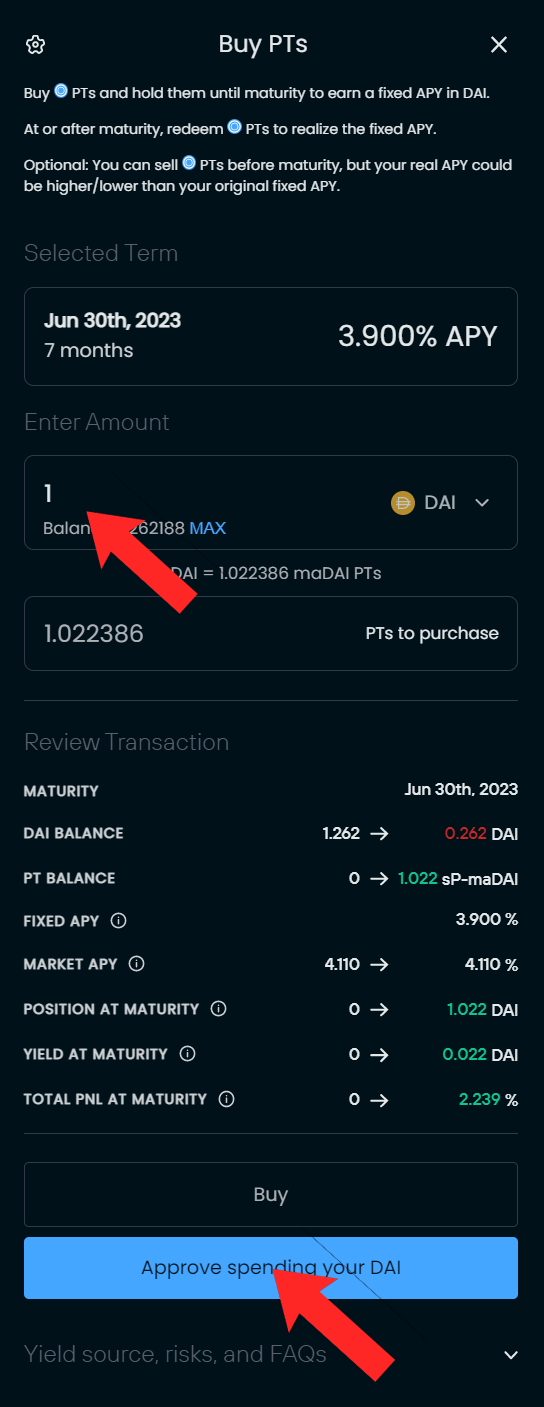

Clicking “Fix Rate” will open a pop-up. First, enter the amount you want to use to purchase fixed rates. This can be done from either the “Underlying” (in this case DAI) or from the “Target” (in this case maDAI). You can switch which asset you’re entering from using the drop down on the right of the “Enter Amount” field of the ticket. You’ll notice that the ticket gives you all kinds of useful information on the transaction before you enter.

One thing that’s neat to note is the “PTs to Purchase” field. This is showing how many PTs you are buying— because PTs become redeemable 1:1 for underlying at maturity, this is really showing you how much underlying you will get at maturity!

If you’re new to Sense you may have to first hit “Approve Spending Your [Asset]” before you can purchase.

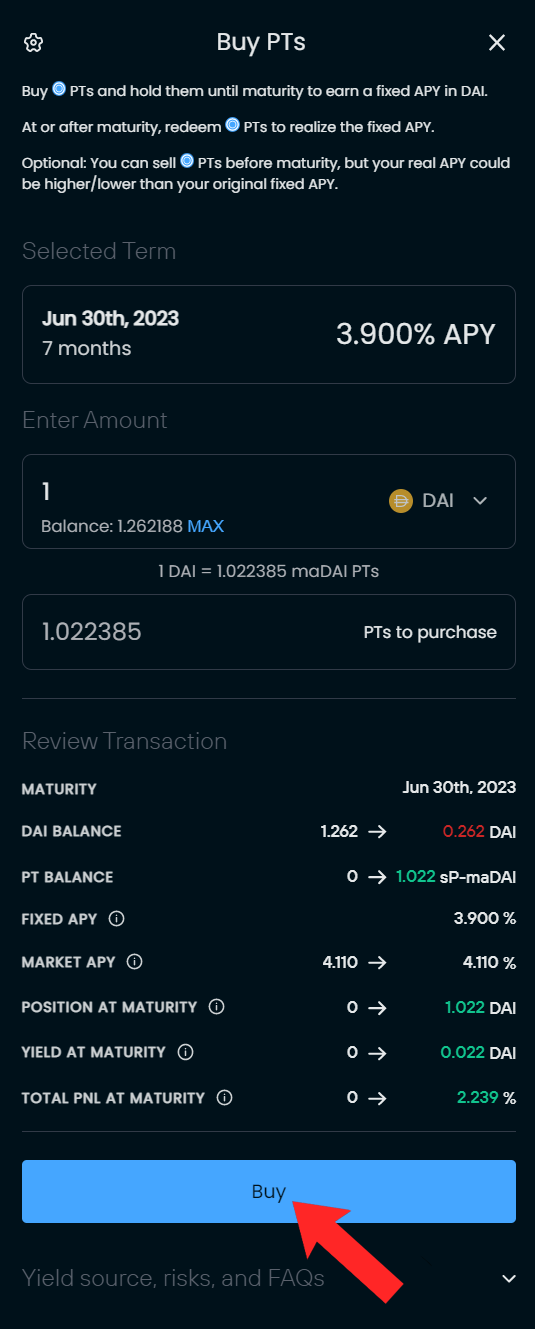

Once you’ve approved Sense with your crypto wallet, you can hit buy. You just locked in a fixed rate! You’ll note that the effective rate shown at the top might not be the same as the fixed rate shown on the page. This is because the rate shown here is subtracting out fees (and if you’re making a larger purchase it will also include your impact on the market price).

# How to Provide Liquidity and Earn A Boosted Yield

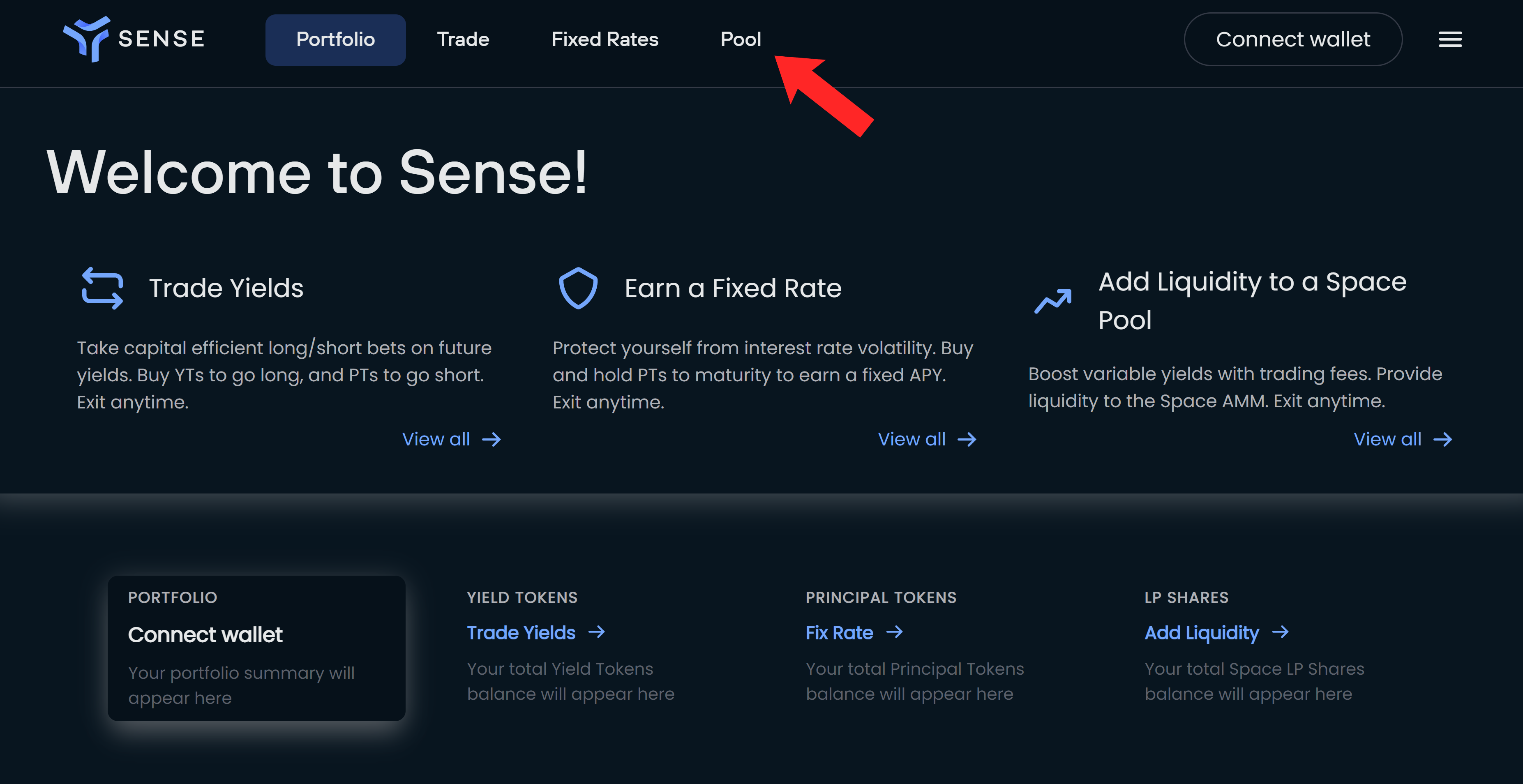

First, navigate from wherever you are in the portal to the “Pool” tab.

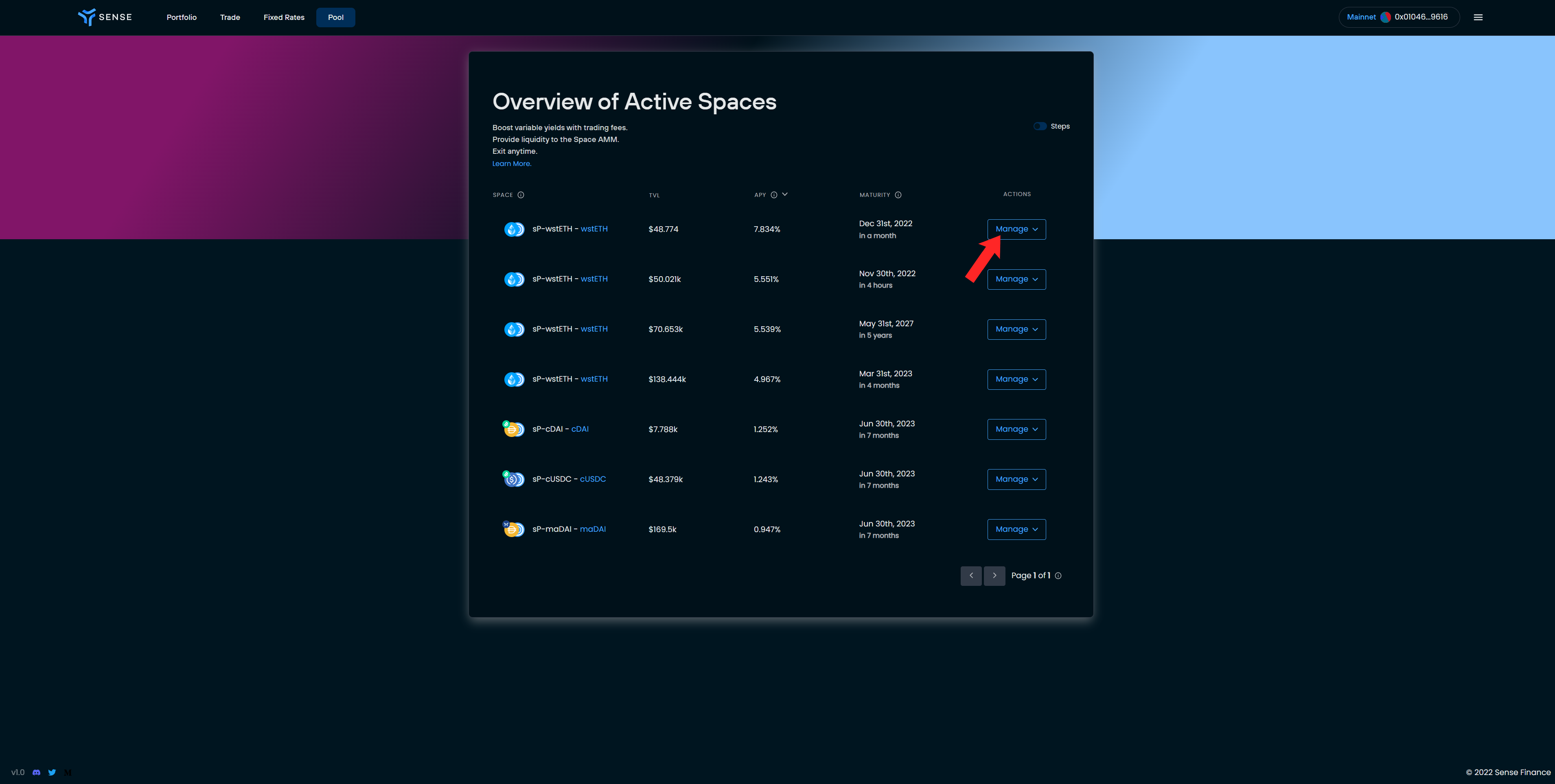

From the “Pool” tab, you’ll see a list of options. Decide which pool you want to add to and open the “Manage” drop down, selecting “Add Liquidity.”

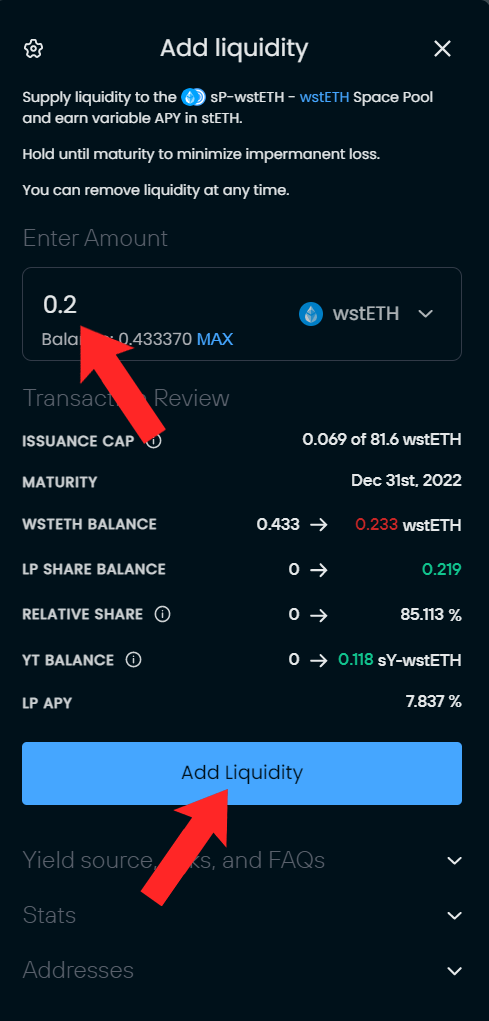

Selecting “Add Liquidity” will open a ticket. Just like with the “How to Get a Fixed Rate” section, you can add from either Underlying or Target and you may need to first approve the spend in your wallet. Once you’ve filled out the ticket and approved the spend from your crypto wallet, click “Add Liquidity.” Congratulations! You are now a Space Pool LP.

# How to Go Long Yields

If you think the variable yield will be higher than the market fixed rate on Sense, you may want to go long rates.

Here’s how.

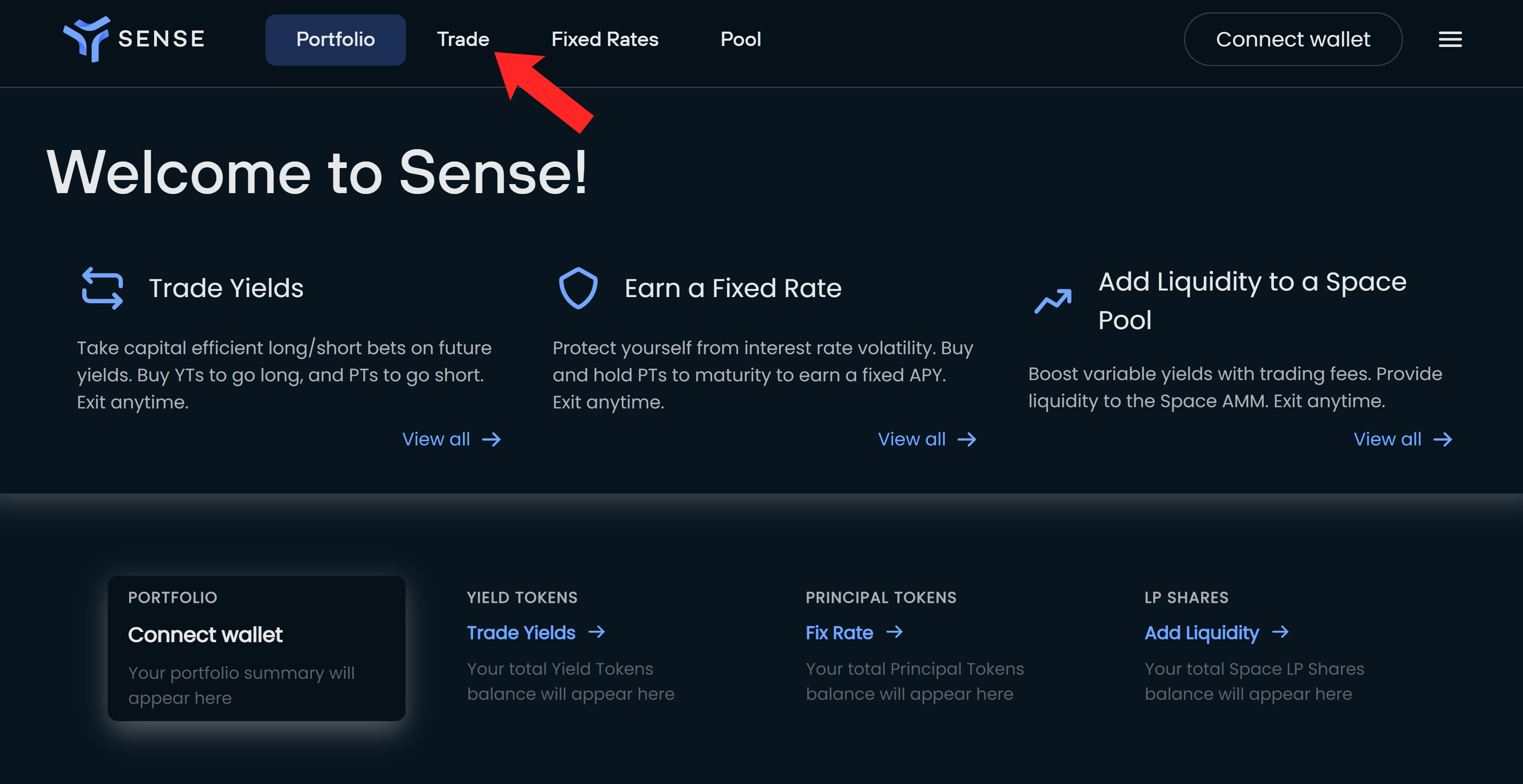

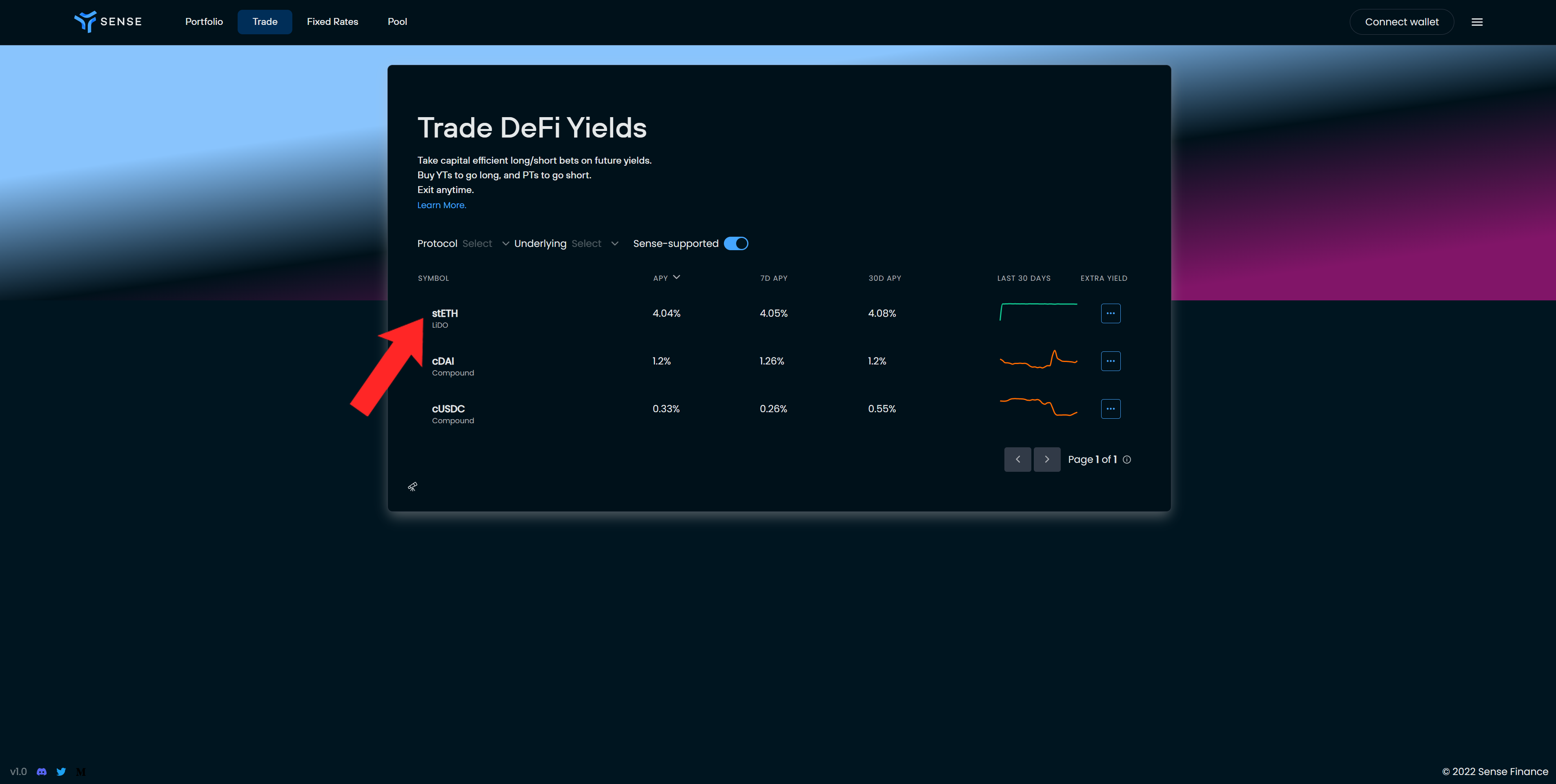

First, navigate to the “Trade” tab from wherever you are in the portal.

On the “Trade” tab, click the asset on which you want to go long yields.

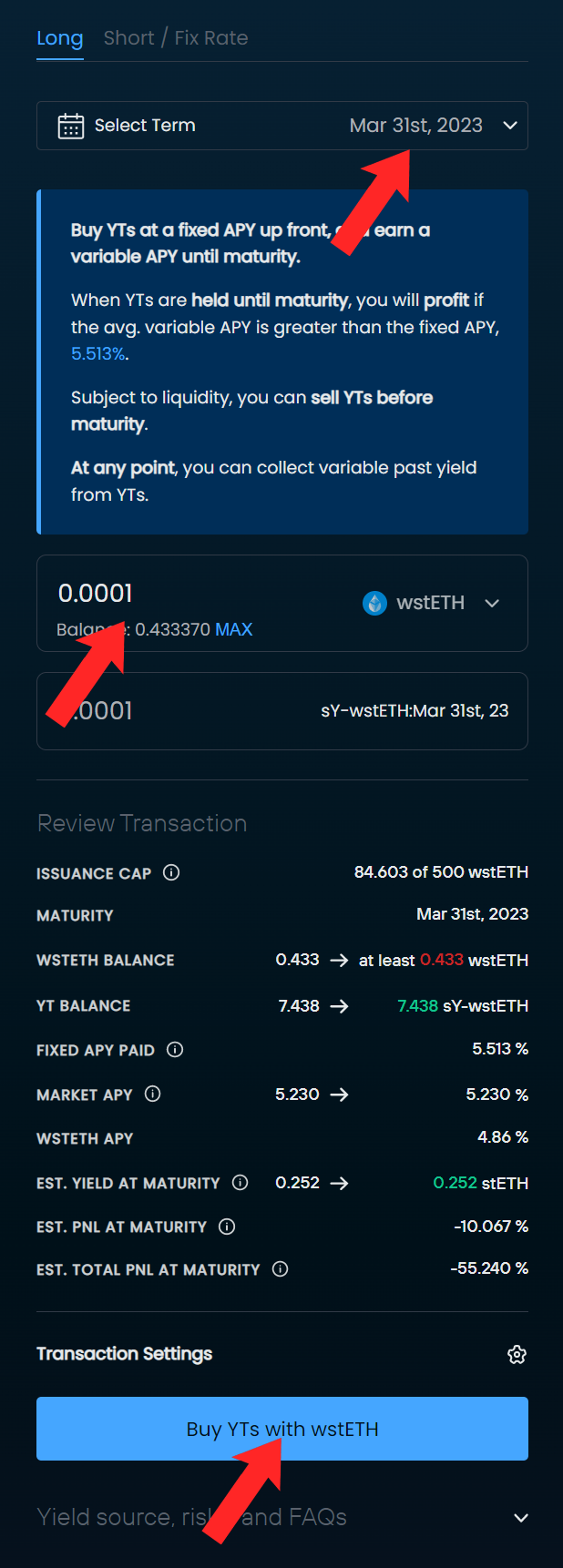

That will take you to the detailed page showing more information about that asset. On the right of that page, you can see a trade ticket. Select the “Long” tab on that trade entry ticket.

This will change the appearance of the ticket, and allow you to go long yields. Select the maturity of the series you want to go long on. The extra information in the blue box will show you the current market fixed rate, which you would be betting is below what the variable yielding asset will earn between now and maturity.

As with the “How to Get Fixed Rates” section, you can enter from either the underlying (stETH in this case) or the target (wstETH in this case), and may need to first approve the spend if you are new to Sense.

Once you’ve approved the spend in your crypto wallet and entered your desired purchase amount, you can hit the “Buy” button to purchase YTs and enter a long variable rates vs fixed rates position.

← FAQ Why Sense? →